Meet Bill Coplin

BILL COPLIN is the founder and professor of the highly successful undergraduate Policy Studies Major at Syracuse University. Its purpose is to provide an undergraduate professional program while maintaining the integrity of a degree in the liberal arts. He is the Laura J. and L. Douglas Meredith Professor for Teaching Excellence at the Maxwell School and College of Arts and Sciences at Syracuse University. An author of 110 books and articles, many of which are in education, he has taught and advised tens of thousands of undergraduates over his 50+ years of teaching.

Coplin’s mission is to equip All students with the practical skills needed for career success while leaving society better than they found it. The Skills Win Program seeks to improve education throughout the United States. Coplin’s mantra “Do Well and Do Good” has motivated generations of Syracuse University alumni to tackle 21st century challenges.

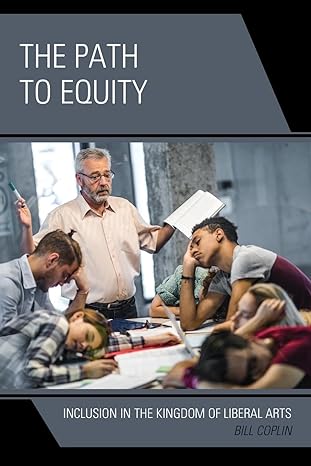

Featured Book

Uncover the role of elitism in “The Path to Equity: Inclusion in the Kingdom of Liberal Arts” as Coplin charts a path to a more equitable and inclusive education system that serves all Americans.

Valleywise Health

Homeland Security Practice Group